MEET THE NEXT GENERATION OF QUANTS

The Quantitative Finance and Risk Management Program is an interdisciplinary master’s degree program in the University of Michigan’s Department of Mathematics and Department of Statistics. Our Quant students come to us from institutions all over the world and graduate with the skills to solve real world financial problems as quantitative analysts, financial engineers, risk managers, and more.

2023 COHORT

2023 COHORT

2023 COHORT

2022 COHORT

2023 COHORT

2023 COHORT

2023 COHORT

2022 COHORT

2022 COHORT

2022 COHORT

2023 COHORT

2022 COHORT

2023 COHORT

2023 COHORT

2022 COHORT

2023 COHORT

2023 COHORT

2023 COHORT

2023 COHORT

2023 COHORT

2023 COHORT

2022 COHORT

2023 COHORT

2023 COHORT

2023 COHORT

2023 COHORT

2023 COHORT

2021 COHORT

2023 COHORT

2023 COHORT

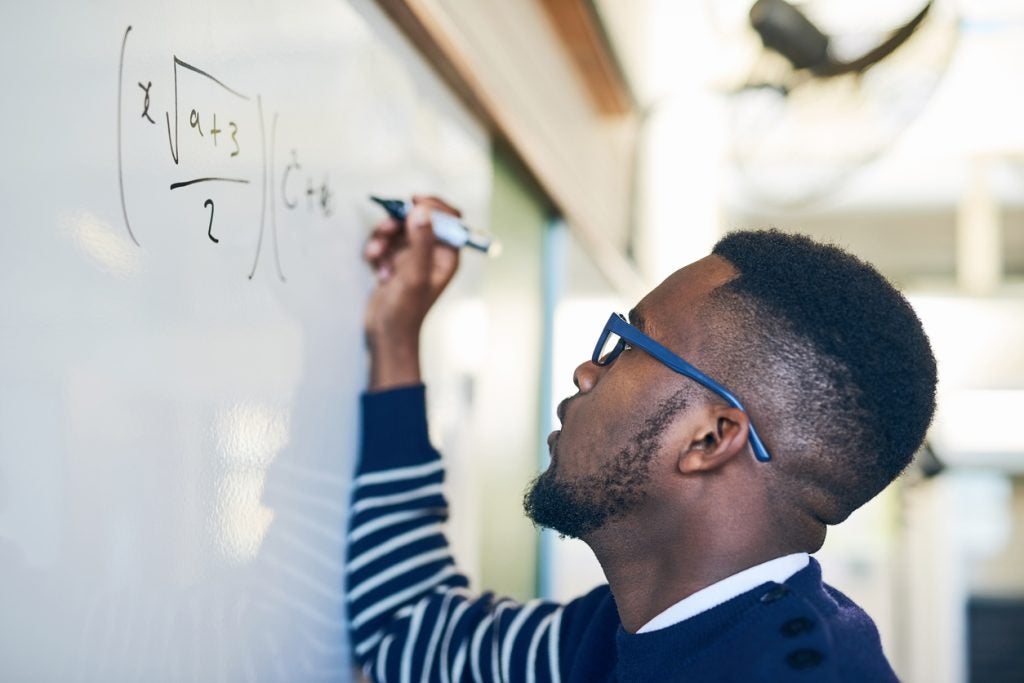

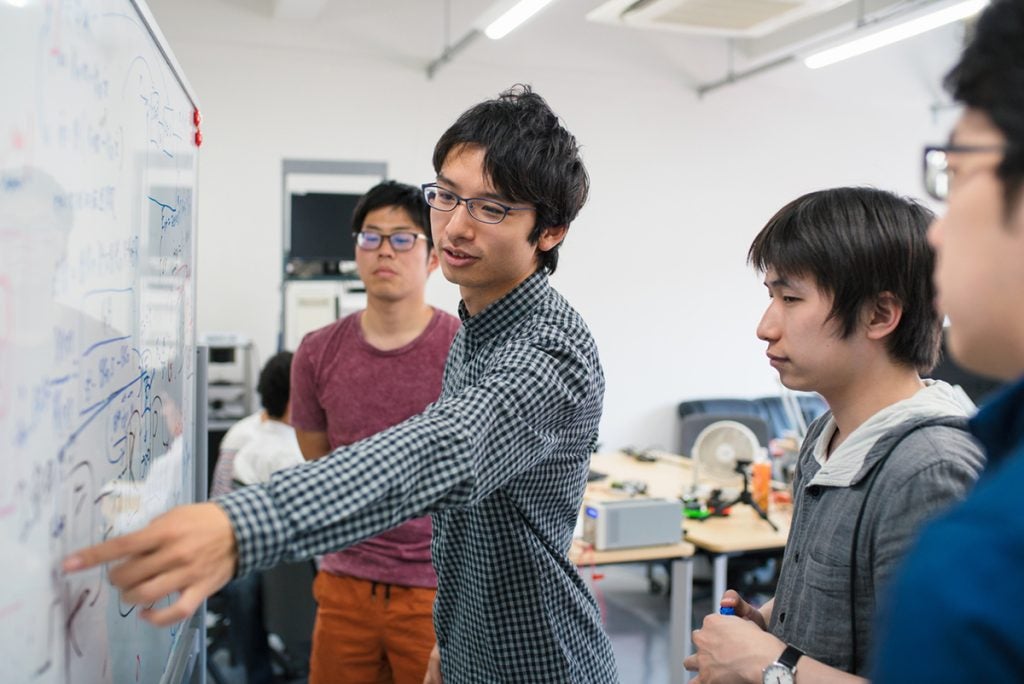

AN INTENSE FOCUS ON

MATHEMATICAL AND STATISTICAL METHODS

169

Average GRE quantitative score for enrolled students

92%

Admitted directly from bachelor’s degree programs

30+

New students each year

86%

Job-seekers placed in summer internships

Latest News

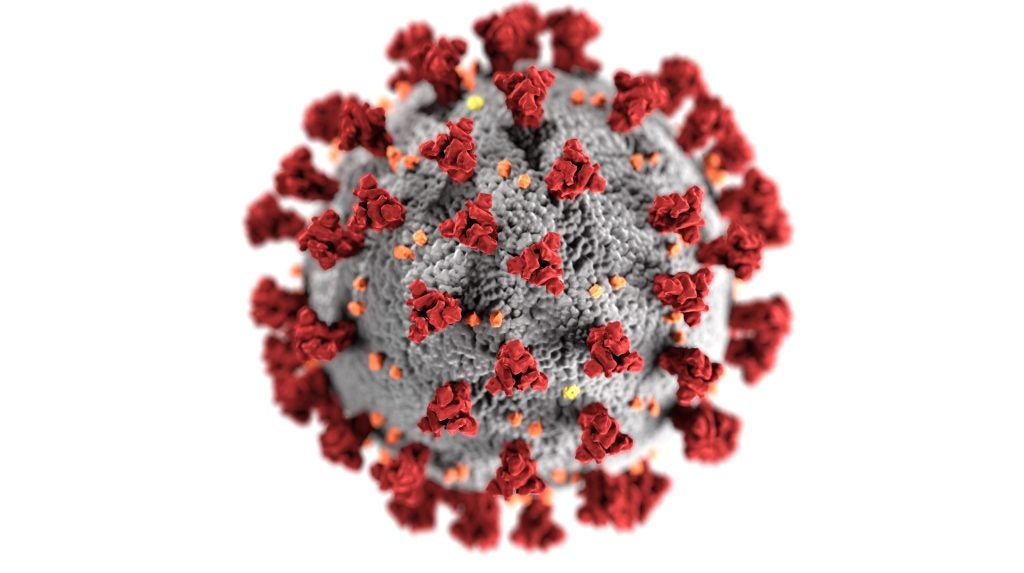

- U-M QFRM Faculty Study Impact of COVID-19 Lockdown Measures

Quantitative Finance faculty, Professors Erhan Bayraktar and Asaf Cohen, applied their expertise in mathematical modeling to the realm of epidemiology in… Continue reading U-M QFRM Faculty Study Impact of COVID-19 Lockdown Measures

Quantitative Finance faculty, Professors Erhan Bayraktar and Asaf Cohen, applied their expertise in mathematical modeling to the realm of epidemiology in… Continue reading U-M QFRM Faculty Study Impact of COVID-19 Lockdown Measures - July 2019: University of Michigan Quant Program Students Win IAQF Student Competition

The International Association of Quantitative Finance (IAQF) announced last week that a team of University of Michigan Quant Program students is… Continue reading July 2019: University of Michigan Quant Program Students Win IAQF Student Competition

The International Association of Quantitative Finance (IAQF) announced last week that a team of University of Michigan Quant Program students is… Continue reading July 2019: University of Michigan Quant Program Students Win IAQF Student Competition